The employer gives you a bonus of Rs 50000 for the financial year. Well lets get to the point of salary. Accenture take home salary calculator.

Accenture Take Home Salary Calculator, These are the details. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Take home salary in accenture india. You can find further information in our dictionary in the area Knowledge.

How Much Monthly Take Home Salary Can I Expect At Inr12 5 Lpa Ctc At Accenture Quora From quora.com

How Much Monthly Take Home Salary Can I Expect At Inr12 5 Lpa Ctc At Accenture Quora From quora.com

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. For Level 9 you should get salary in the range of 12 to 18 Lakhsannum. FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc. The calculator can help you find your monthly net salary if you know your salary package.

Calculate Take Home Salary.

Read another article:

Note that this package is given by the technical wing of Accenture. The employer gives you a bonus of Rs 50000 for the financial year. Your average tax rate is 220 and your marginal tax rate is 353. In order to calculate your Take-Home Salary or Net Salary follow these steps. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Source: salaryexplorer.com

Source: salaryexplorer.com

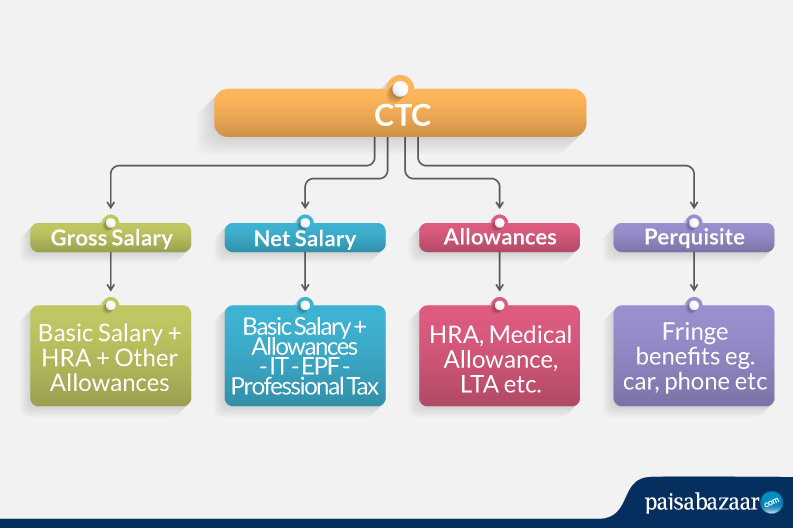

Your Total Income After Tax. To calculate the take-home salary you must enter the Cost To Company CTC and the bonus if any as a fixed amount or a percentage of the CTC. Calculate Take Home Salary. These include income tax as well as National Insurance payments. Average Salary In Warsaw 2021 The Complete Guide.

Source: jupiter.money

Source: jupiter.money

We have provided some easy steps to help you calculate your take-home salary also known as in-hand salary and net salary. Note that this package is given by the technical wing of Accenture. Step 1- Calculate Gross Salary Gross Salary Basic Salary HRA Other Allowances Alternatively Gross Salary CTC EPF Gratuity Step 2- Calculate Taxable Income Taxable Income Income Gross Salary other income Deductions. Calculated values may not match. Salary Calculator In Hand Take Home Salary Jupiter.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. Subtract the Income Tax Provident Fund PF and Professional Tax from the Gross Salary determined in step 1. It is offering a package of 315 to 33 lakh per annum in the campus. Please note that our salary calculator is calculating this for FY 2021-22 Current Financial Year. What Is The Monthly Take Home Salary From Accenture If Fixed Pay Is 17 45 Lpa Quora.

Source: pinterest.com

Source: pinterest.com

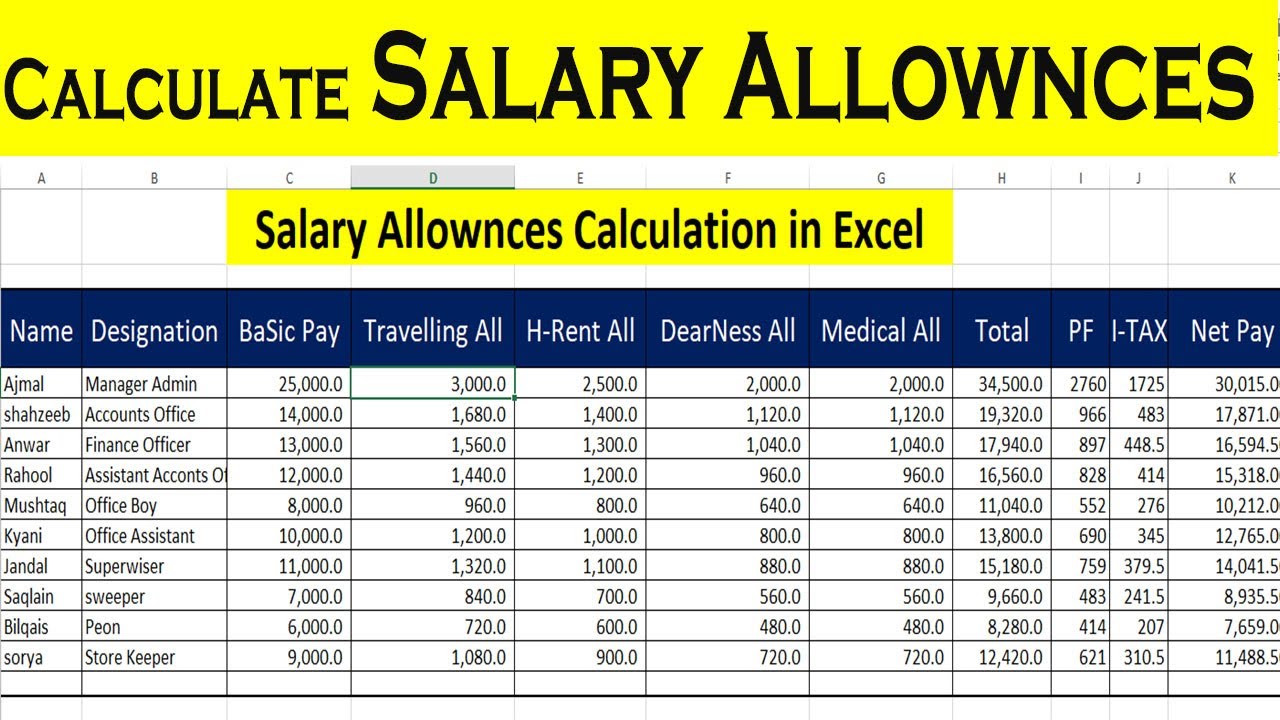

These are the details. Take-Home Salary Rs 750000 Rs 48600 Rs 701400. Calculate gross salary Gross Salary CTC EPF Gratuity. Calculate Take Home Salary. Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Tax Deductions Learning Centers Excel Tutorials.

Source: paisabazaar.com

Source: paisabazaar.com

Calculate Take Home Salary. Calculate gross salary Gross Salary CTC EPF Gratuity. Team Leader salaries at Accenture can range from 119118 - 12529500 per year. Take Home Salary Gross Salary - Income Tax - Employees PF Contribution PF - Prof. Salary Structure Components How To Calculate Take Home Salary.

Source: mygreatlearning.com

Source: mygreatlearning.com

Calculation are split by week month and year. The employer gives you a bonus of Rs 50000 for the financial year. For Level 9 you should get salary in the range of 12 to 18 Lakhsannum. Step 1- Calculate Gross Salary Gross Salary Basic Salary HRA Other Allowances Alternatively Gross Salary CTC EPF Gratuity Step 2- Calculate Taxable Income Taxable Income Income Gross Salary other income Deductions. Salary Calculator In Hand Salary Calculator Great Learning.

Yes the variable component is 027 and I am assuming you are joining as a consultant at level 9. Team Leader salaries at Accenture can range from 119118 - 12529500 per year. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. Find out the benefit of that overtime. 2.

Source: quora.com

Source: quora.com

That means that your net pay will be 40568 per year or 3381 per month. For example your Cost To Company CTC is Rs 8 lakh. In order to calculate your Take-Home Salary or Net Salary follow these steps. Calculate Take Home Salary. How Much Monthly Take Home Salary Can I Expect At Inr12 5 Lpa Ctc At Accenture Quora.

Source: fishbowlapp.com

Source: fishbowlapp.com

These are the details. Salaries posted anonymously by Accenture employees. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. Hi Folks Any Idea How Much Will Be Take Home Salary Ambition Box Salary Calculator Is Predicting Around 61 63k Fishbowl.

If you make CHF 50000 a year living in the region of Zurich Switzerland you will be taxed CHF 8399That means that your net pay will be CHF 41602 per year or CHF 3467 per month. Team Leader salaries at Accenture can range from 119118 - 12529500 per year. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. For example your Cost To Company CTC is Rs 8 lakh. How Much Monthly Take Home Salary Can I Expect At Inr12 5 Lpa Ctc At Accenture Quora.

Source: khatabook.com

Source: khatabook.com

Calculate gross salary Gross Salary CTC EPF Gratuity. Take home salary in accenture india. TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000 FY 2020 2021. It is going to the campus for placements. Salary Calculator 2020 21 Take Home Salary Calculator India.

Youll then get a breakdown of your total tax liability and take-home pay. Your total gross salary is Rs 800000 Rs 50000 Rs 750000. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. This marginal tax rate means that your immediate additional income will be taxed at this rate. How Much In Hand Salary Can I Expect From In Persistent Ctc 9 5 Lpa Quora.

Source: fishbowlapp.com

Source: fishbowlapp.com

The calculation of salaries however is difficult for immigrants and requires the consideration of a variety of criteria. ICalculator also provides historical Indian earning figures so individual employees and employers can review how much tax has been paid in previous assessment years or you can use the salary calculator 202122 to see home much your take home salary. These are the details. Take-home pay known as in-hand salary in India is the net salary after deducting income tax TDS tax deducted at source in India and other deductions from the gross monthly pay. Can Someone Pls Help Me Calculate If I Am Given 8lpa Fixed 21 Variable Pay In Accenture What Will Be My Monthly Inhand Salary And Is It A Good Salary.

Source: youtube.com

Source: youtube.com

Well lets get to the point of salary. That means that your net pay will be 40568 per year or 3381 per month. Your average tax rate is 168 and your marginal tax rate is 269This marginal tax rate means that your immediate additional income will be taxed at this rate. FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc. Accenture Complete In Hand Salary Accenture Monthly Salary Accenture Extra Allowances Youtube.

Source: in.pinterest.com

Source: in.pinterest.com

Salary calculations include gross annual income tax deductible elements such as NIS NHT education tax and include age related tax allowances. Well lets get to the point of salary. Subtract the Income Tax Provident Fund PF and Professional Tax from the Gross Salary determined in step 1. Calculate gross salary Gross Salary CTC EPF Gratuity. Gate 2021 Gate Exam Exam Gate.