In the past it was critical for homeowners to save receipts for anything that could qualify as an improvement. Spending 100000 on home improvements and deducting them at the end of the year sounds pretty great right. Are home improvements tax deductible in 2017.

Are Home Improvements Tax Deductible In 2017, However there are some projects that are exceptions so be sure to do your research or speak to your tax advisor on whether your remodel is. This is unlike many other deductions pertaining to your home. To be eligible for depreciation on home renovation and improvement expenses you must utilize a part of your house for purposes. Heres what you need to know about tax deductible home improvements.

Are Home Staging Costs Tax Deductible Claudia Jacobs Designs From claudiajacobsdesigns.com

Are Home Staging Costs Tax Deductible Claudia Jacobs Designs From claudiajacobsdesigns.com

The IRS states that energy saving improvements made to a personal dwelling before January 1 2020 qualify for the credit which is equal to 30 of the cost of the equipment. Luckily there are a few exceptions to this rule. Unfortunately the details on deductions related to improvements are complicated. If youve made repairs or renovations to your primary home you generally cant claim home improvement deductions when its time to file your taxes.

Although home improvements cannot be deducted they may be depreciated.

Read another article:

However home improvement costs can increase the basis of your property. Is a new roof tax deductible. Unless you sell your home what you spend on improvements wont affect this years taxeseven if those renovations greatly affected your. Every dime added to the basis was a dime less that the IRS could tax when the house was sold. Generally you cant write off most home improvements.

Source: builddirect.com

Source: builddirect.com

Home Used Exclusively as a Residence If you only use your house as a residence the costs of home improvements are not tax-deductible but they may reduce the amount of taxes youll need to pay later when you sell your home. Unless you sell your home what you spend on improvements wont affect this years taxeseven if those renovations greatly affected your. Home improvement loans You probably already know that your property taxes are usually tax-deductible but you can also deduct the interest on a home improvement loan. Generally you cant write off most home improvements. What Is The Potential For Tax Deduction With Home Improvements.

Source: credible.com

Source: credible.com

There are many different deductions that apply to homeowners especially homeowners who have invested in improving their home. But now that home-sale profits are tax-free for most owners theres no guarantee that carefully tracking your basis will pay off. There are some exceptions to this rule however which well explain below. According to BudgetDumpster home office improvements are deductible over time with depreciation and repairs are deductible within the tax year they are completed since theyre considered necessary for the upkeep of your business Typical improvements include new paint lighting or flooring. Mortgage Refinance Tax Deductions Every Homeowner Should Know Credible.

Source: nytimes.com

Source: nytimes.com

The IRS usually limits you to just your primary residence since that is the one that you live in most of the time. The answer could be yes or no. However there are circumstances when improvements to the home can become eligible as a deduction. Repairs are projects designed to restore the home to its initial valuation whereas improvements add to the value of your home. Interest On Home Equity Loans Is Still Deductible But With A Big Caveat The New York Times.

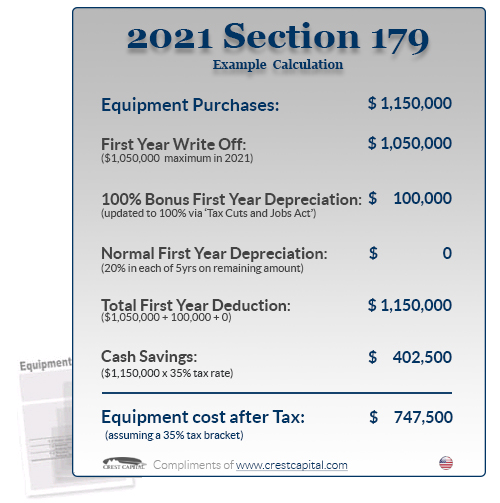

Source: section179.org

Source: section179.org

Can I Get a Tax Deduction for Home Improvements. Home improvement loans You probably already know that your property taxes are usually tax-deductible but you can also deduct the interest on a home improvement loan. The answer could be yes or no. Are you planning on making a few upgrades to your house or a rental property you own. Section 179 Tax Deduction For 2021 Section179 Org.

Source: pinterest.com

Source: pinterest.com

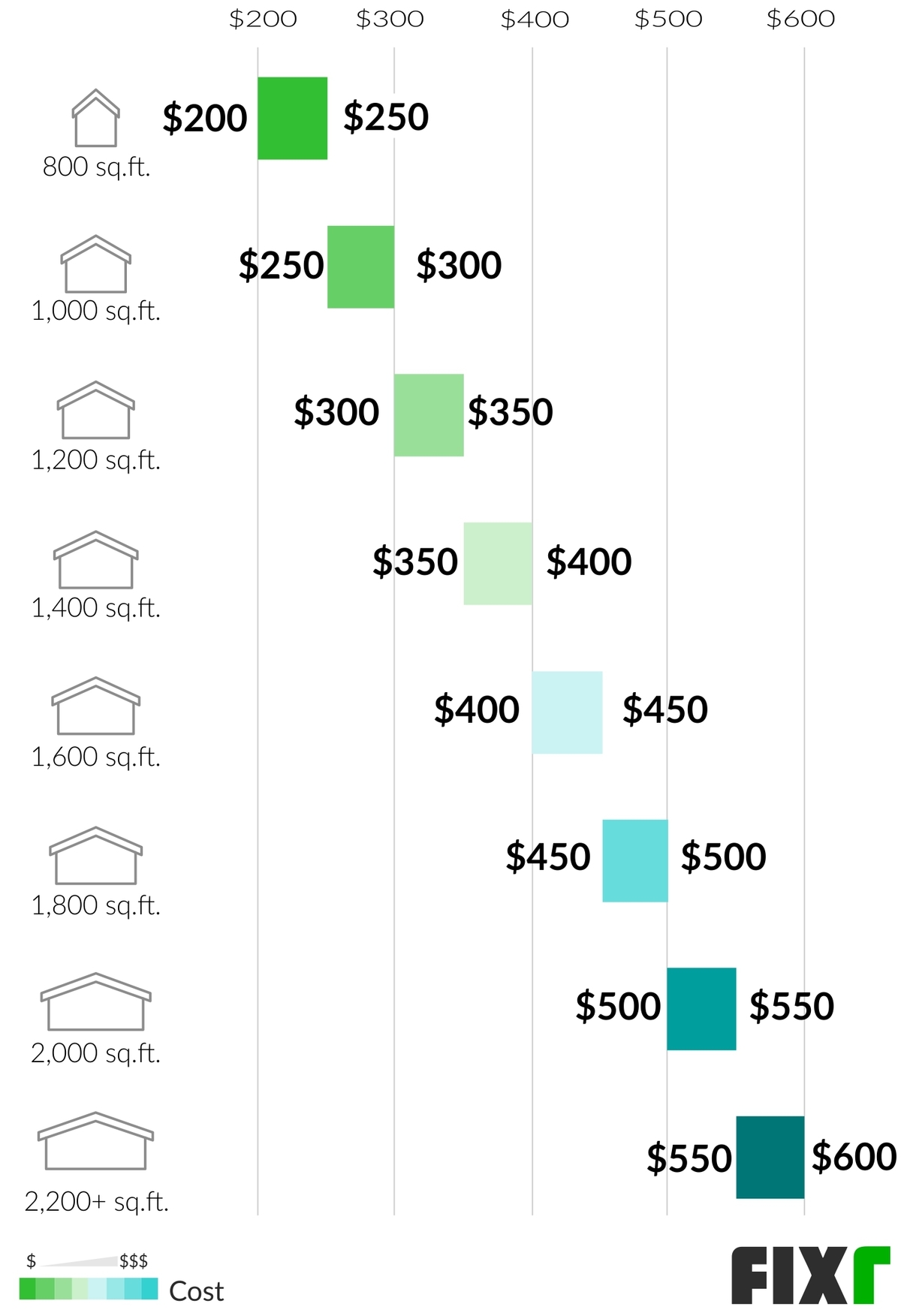

Are you planning on making a few upgrades to your house or a rental property you own. According to BudgetDumpster home office improvements are deductible over time with depreciation and repairs are deductible within the tax year they are completed since theyre considered necessary for the upkeep of your business Typical improvements include new paint lighting or flooring. Unless you sell your home what you spend on improvements wont affect this years taxeseven if those renovations greatly affected your. Once you make a home improvement like putting in central air conditioning installing a sun-room or upgrading the roof you are not able to deduct the. Five Ways Mortgage Tax Deduction Can Improve Your Business Mortgage Tax Deduction Https Ift Tt 36kzc4m Home Equity Home Equity Loan Equity.

Source: pinterest.com

Source: pinterest.com

You can claim thousands of dollars after a renovation all you need to know is what you can claim and when. What home improvements are tax deductible. Your tax basis is subtracted from your final selling price to determine your profit. This dollar-for-dollar reduction of your tax bill called the Renewable Energy Tax Credit was introduced as an effort to incentivize homeowners to make their homes more energy-efficient. Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Being A Landlord Business Tax Deductions Business Tax.

Source: keepertax.com

Source: keepertax.com

Spending 100000 on home improvements and deducting them at the end of the year sounds pretty great right. There are some exceptions to this rule however which well explain below. Luckily there are a few exceptions to this rule. Can I Get a Tax Deduction for Home Improvements. Quiz Do I Qualify For The Home Office Deduction.

Source: houselogic.com

Source: houselogic.com

In the past it was critical for homeowners to save receipts for anything that could qualify as an improvement. Home improvement loans You probably already know that your property taxes are usually tax-deductible but you can also deduct the interest on a home improvement loan. Green homes home improvement home improvement loan home renovation tax deductions Audrey Ference has written for The Billfold The Hairpin The Toast Slate Salon and others. The IRS states that energy saving improvements made to a personal dwelling before January 1 2020 qualify for the credit which is equal to 30 of the cost of the equipment. Mortgage Interest Deduction Or Standard Deduction Houselogic.

Source: walletgenius.com

Source: walletgenius.com

Luckily there are a few exceptions to this rule. It is important to contact a tax professional to be sure any deductions taken are allowed. The IRS states that energy saving improvements made to a personal dwelling before January 1 2020 qualify for the credit which is equal to 30 of the cost of the equipment. Once you make a home improvement like putting in central air conditioning installing a sun-room or upgrading the roof you are not able to deduct the. 6 Tax Deductible Home Improvement Repairs For 2021 Walletgenius.

Can I Get a Tax Deduction for Home Improvements. Home Used Exclusively as a Residence If you only use your house as a residence the costs of home improvements are not tax-deductible but they may reduce the amount of taxes youll need to pay later when you sell your home. A home renovation can be a lucrative tax-deductible investment if you are aware of your tax entitlements. She lives in Austin. 2.

Source: ctpost.com

Source: ctpost.com

Home Improvement Loan Interest Tax Deductions As with a home equity loan the interest from a home improvement loan can be deductible up to 100000. Home Improvements That Are Tax Deductible. Home improvement loans You probably already know that your property taxes are usually tax-deductible but you can also deduct the interest on a home improvement loan. Home improvement projects are typically not eligible for tax deductions. Top Tax Benefits Of Home Ownership.

Source: claudiajacobsdesigns.com

Source: claudiajacobsdesigns.com

It is important to contact a tax professional to be sure any deductions taken are allowed. In the past it was critical for homeowners to save receipts for anything that could qualify as an improvement. Unfortunately you cannot deduct the cost of a new roof. Repairs include things like carpet cleaning. Are Home Staging Costs Tax Deductible Claudia Jacobs Designs.

Source: pinterest.com

Source: pinterest.com

Unfortunately the details on deductions related to improvements are complicated. Is a new roof tax deductible. Are Home Improvements a Deductible Expense. Home improvements and repairs are often considered nondeductible personal expenses. Publication 587 2013 Business Use Of Your Home Daycare Business Plan Small Business Advice Business.

Source: youngandthrifty.ca

Source: youngandthrifty.ca

Home improvements and repairs are often considered nondeductible personal expenses. Home improvement loans You probably already know that your property taxes are usually tax-deductible but you can also deduct the interest on a home improvement loan. Home improvements and repairs are often considered nondeductible personal expenses. It is important to contact a tax professional to be sure any deductions taken are allowed. Tax Deductions On Rental Property Income In Canada Young And Thrifty.

Source: nerdwallet.com

Source: nerdwallet.com

Home improvement projects are typically not eligible for tax deductions. Luckily there are a few exceptions to this rule. This is unlike many other deductions pertaining to your home. The IRS usually limits you to just your primary residence since that is the one that you live in most of the time. 5 Big Rental Property Tax Deductions Nerdwallet.