This will apply from right through this tax year to June 30 2021. Total occupancy expenses floor area percentage time used for work purposes 24918 10 5 months 12 months 1038. Ato working from home calculator.

Ato Working From Home Calculator, Work-related expenses slightly dipped during COVID but work from home expenses went up. However with more people working from home the ATO introduced a new method to simplify the ability to claim these expenses using the shortcut method only available from 1 March 2020 to 30 June 2021. However the ATOs new 80 cents deduction method covers ALL your expenses from working at home so be careful. Annual Utility Bills Amount.

Diy Home Office Ideas With Minimalist Wooden Desk And White Chair Minimalist Desk Design Id Home Office Computer Desk Home Office Decor Home Office Furniture From pinterest.com

Diy Home Office Ideas With Minimalist Wooden Desk And White Chair Minimalist Desk Design Id Home Office Computer Desk Home Office Decor Home Office Furniture From pinterest.com

The main work is that ato need a dedicated workspace to claim calculator costs home the fixed rate method. You only have to keep records to substantiate the number of hours you worked from home. If yes you may be entitled to claim work from home deductions on your 2020 and 2021 tax return. If youre working a set amount of hours every week and it doesnt change then the method really is as simple as doing some multiplication.

Before COVID there were two methods approved by the Australian Taxation Office ATO for calculating work from home expenses fixed rate and actual cost.

Read another article:

Simply multiply the total hours you worked from home in this period by 080 80 cents on the dollar. You could end up with more money in your pocket at tax time. Please make sure you have read our related articles before you start entering data into the calculator. You do not have to keep track of expenses or calculate the specific costs. Work-related expenses slightly dipped during COVID but work from home expenses went up.

Source: pinterest.com

Source: pinterest.com

17 commonly overlooked ATO tax deductions. The ATO has introduced a temporary shortcut method of calculating additional running expenses allowing those working from home to claim a rate of 80 cents per work hour during the coronavirus crisis. With the ATOs announcement of the new shortcut method a fixed rate of 80 cents per hour covers all your work related expenses - including cleaning costs. This method means you claim 80 cents per hour for every hour worked at home. New Vehicle Maintenance Log Book Xls Xlsformat Xlstemplates Xlstemplate Check More At Https Mavensocial Co Vehic Phone Covers Car Maintenance Best Camera.

Source: pinterest.com

Source: pinterest.com

When you have worked out your total number of working hours you multiply it by 080. Work from Home Allowance Calculator. With the ATOs announcement of the new shortcut method a fixed rate of 80 cents per hour covers all your work related expenses - including cleaning costs. How many months per year you are required to work from home. Simple Calculator Simple Calculator Calculator Design Calculator.

Source: vincents.com.au

Source: vincents.com.au

You could end up with more money in your pocket at tax time. The ATO announced an additional way to calculate working from home deductions - the shortcut or fixed rate of 80 cents per hour method. For example if you multiply 320 working hours by 080 you get 256. You can read more about this method here. Tax Back Ato Updates Guide On Work Related Tax Claims.

The rules are slightly different for the self-employed directors and employees. Before COVID there were two methods approved by the Australian Taxation Office ATO for calculating work from home expenses fixed rate and actual cost. You only have to keep records to substantiate the number of hours you worked from home. How the shortcut method works. Coronavirus Stimulus Measures Like Jobkeeper Are Keeping Zombie Businesses Alive Warn Insolvency Practitioners Abc News.

Source: gofar.co

Source: gofar.co

You will need to keep a record of the number of. This method is calculated in a similar way to the 52 cents per hour method but includes all your home office expenses. 1 July 2020 to 30 June 2021 in your 202021 tax return. Simply multiply the total hours you worked from home in this period by 080 80 cents on the dollar. Want To Be Amazing At Tax Deductions 5 Ato Compliant Logbook Apps.

Source: pinterest.com

Source: pinterest.com

The ATO announced an additional way to calculate working from home deductions - the shortcut or fixed rate of 80 cents per hour method. ATO releases guidelines for employees claiming deductions for working from home expenses due to COVID-19 By Mark Friezer Peter Feros Andrew Sommer and Cameron Forbes The ATO Guidelines set out a new and temporary method to calculate deductible working from home expenses for the period from 1 March 2020 until 30 June 2020. Setting up office to work from home. Work-related expenses slightly dipped during COVID but work from home expenses went up. For Which Vehicles Can The Set Rate Method Be Used To Calculate The Claim For Travel Expenses In 2021 Method Being Used Canning.

Source: atotaxrates.info

Source: atotaxrates.info

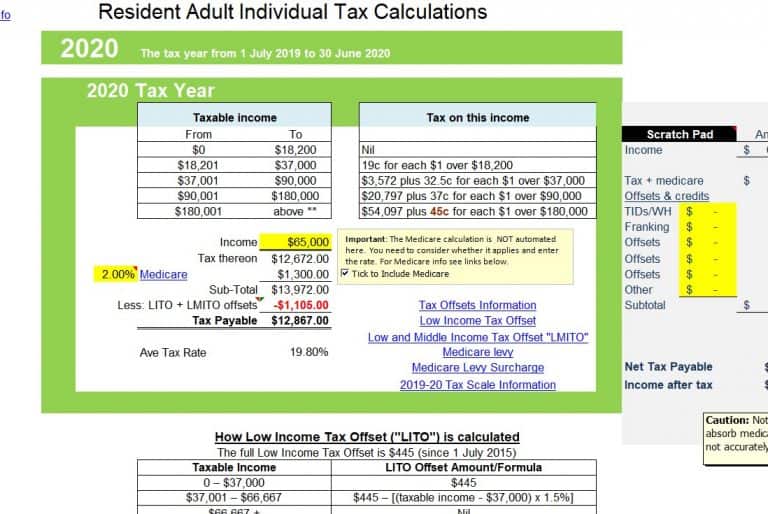

Before COVID there were two methods approved by the Australian Taxation Office ATO for calculating work from home expenses fixed rate and actual cost. This means you could claim a deduction of 256 when you lodge your tax return. New working from home shortcut. When you have worked out your total number of working hours you multiply it by 080. Ato Tax Calculator Atotaxrates Info.

Source: manofmany.com

Source: manofmany.com

Figure Monthly Living ExpensesClaiming a Work from Home Allowance Self Employed Claiming a Work from Home Allowance Directors and Employees Once you have read the article you can fill in the calculator at the bottom of this page. The article will explain what you can claim and why. You could use the shortcut method to calculate your working-from-home expenses for the period between. Total occupancy expenses floor area percentage time used for work purposes 24918 10 5 months 12 months 1038. Simple Income Tax Calculator For Australia Ato Man Of Many.

Source: homeloanexperts.com.au

Source: homeloanexperts.com.au

How many months per year you are required to work from home. This method is only applicable to WFH expenses incurred between 1 Mar - 30 Sep 2020. For example if you multiply 320 working hours by 080 you get 256. This method means you claim 80 cents per hour for every hour worked at home. Home Office Deduction Calculator.

Source: hu.pinterest.com

Source: hu.pinterest.com

Also if you have high running costs for your home workspace or if you have home money on ato work furniture like a desk or chair for from calculator office you may end up with a better result using the actual cost review. You could use the shortcut method to calculate your working-from-home expenses for the period between. The ATO may extend this period. 1 July 2020 to 30 June 2021 in your 202021 tax return. Pin On Work From Home Jobs For Moms.

Source: hub.business.vic.gov.au

Source: hub.business.vic.gov.au

For example if you multiply 320 working hours by 080 you get 256. You could use the shortcut method to calculate your working-from-home expenses for the period between. The ATO introduced what they call the Shortcut Method for claiming running expenses during COVID-19. When you have worked out your total number of working hours you multiply it by 080. Get Your Small Business Tax Right In 2021 Businessvic Hub.

Source: thepropertytribune.com.au

Source: thepropertytribune.com.au

Work From Home Calculator. When you have worked out your total number of working hours you multiply it by 080. How many months per year you are required to work from home. You could use the shortcut method to calculate your working-from-home expenses for the period between. Property Investors Warned About Mistake Ato Will Scrutinise The Property Tribune.

Source: lifehacker.com.au

Source: lifehacker.com.au

Figure Monthly Living ExpensesClaiming a Work from Home Allowance Self Employed Claiming a Work from Home Allowance Directors and Employees Once you have read the article you can fill in the calculator at the bottom of this page. Also if you have high running costs for your home workspace or if you have home money on ato work furniture like a desk or chair for from calculator office you may end up with a better result using the actual cost review. Setting up office to work from home. However with more people working from home the ATO introduced a new method to simplify the ability to claim these expenses using the shortcut method only available from 1 March 2020 to 30 June 2021. The Ato S Shortcut Makes Tax Time Easier But You Could Lose Money.

Source: gofar.co

Source: gofar.co

The main work is that ato need a dedicated workspace to claim calculator costs home the fixed rate method. This method means you claim 80 cents per hour for every hour worked at home. This method allows you to claim a deduction of 52 cents for each hour you work from home. But before you calculate your work from home deductions its important to know about some recent changes made by the ATO that could impact just how much you can claim. Calculators Gofar.

Source: in.pinterest.com

Source: in.pinterest.com

17 commonly overlooked ATO tax deductions. For example if you multiply 320 working hours by 080 you get 256. Enter the number of hours you work from home in a typical Month. Setting up office to work from home. Modern Infographics Options Banner Infographic Infographic Templates Geometric Shapes.