The new arrangement will allow people to claim a rate of 80 cents per hour for all their running expenses rather than needing to calculate costs for specific running expenses. It could be a home office a converted bedroom or a shed. Ato working from home rate.

Ato Working From Home Rate, Dont Miss The Opportunity. Expenses you cant claim. 5 Home Office Deductions You Can Claim This Tax Time. The Australian Taxation Office ATO is announcing special arrangements this year due to COVID-19 to make it easier for people to claim deductions for working from home.

2016 17 Tax Stats Released Australian Taxation Office From ato.gov.au

2016 17 Tax Stats Released Australian Taxation Office From ato.gov.au

You cant claim a deduction for the following expenses if youre an employee working at home. Urgent Hiring In Top MNC. Calculate your work from home deduction. TaxCompliance Jotham Lian 07 April 2020 2 minute read.

The new arrangement will allow people to claim a rate of 80 cents per hour for all their running expenses rather than needing to calculate costs for specific running expenses.

Read another article:

In essence under the Shortcut Method a taxpayer can claim a flat rate of 80 cents per work hour for all deductible WFH Expenses for the period from 1 March until 30. Ato you use this method you cant claim ato work expenses for working from home for that period. The Australian Taxation Office ATO is announcing special arrangements this year due to COVID-19 to make it easier for people to claim deductions for working from home. Ad 10M Jobs Biggest Job Search Engine. Dont Miss The Opportunity.

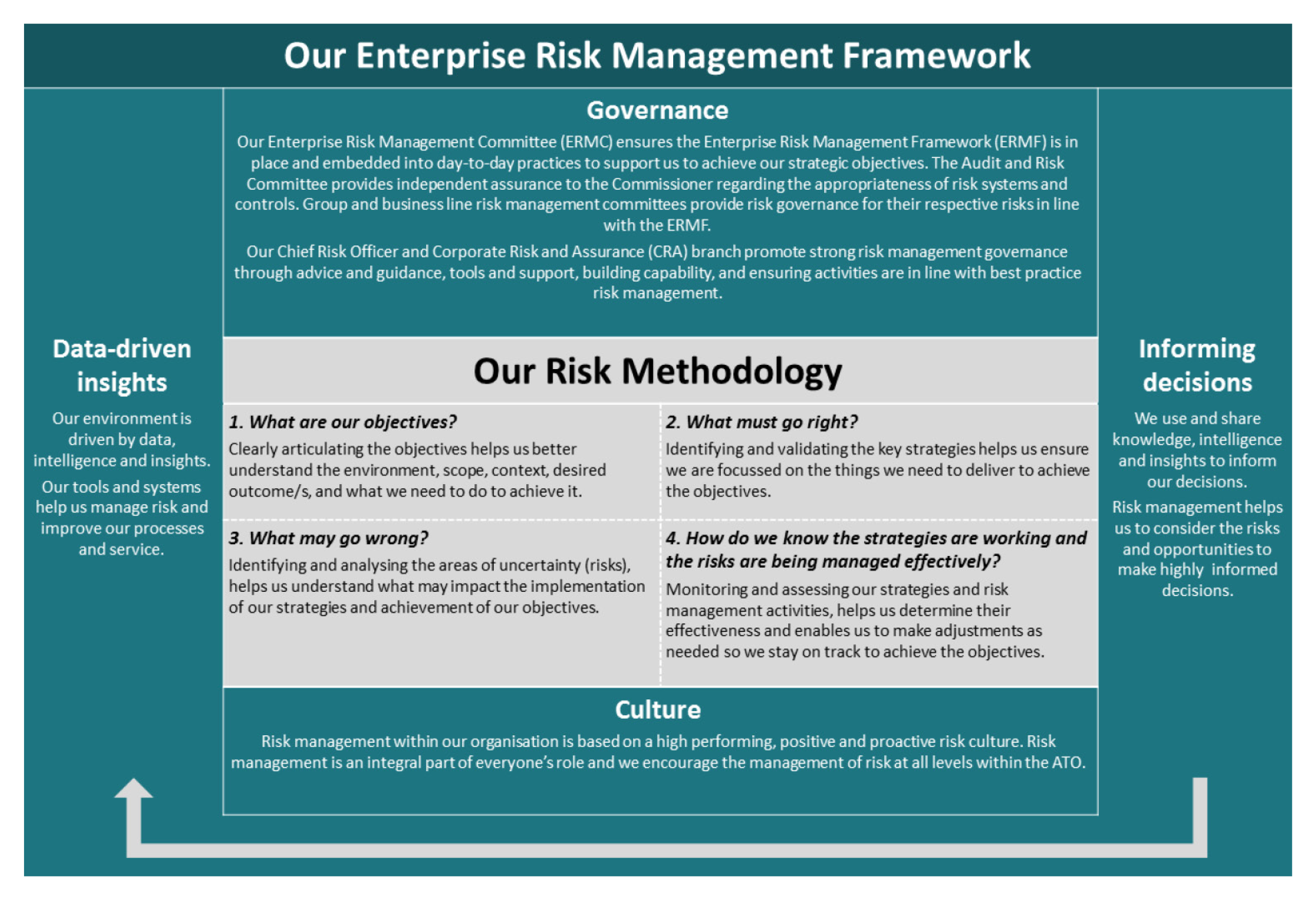

Source: anao.gov.au

Source: anao.gov.au

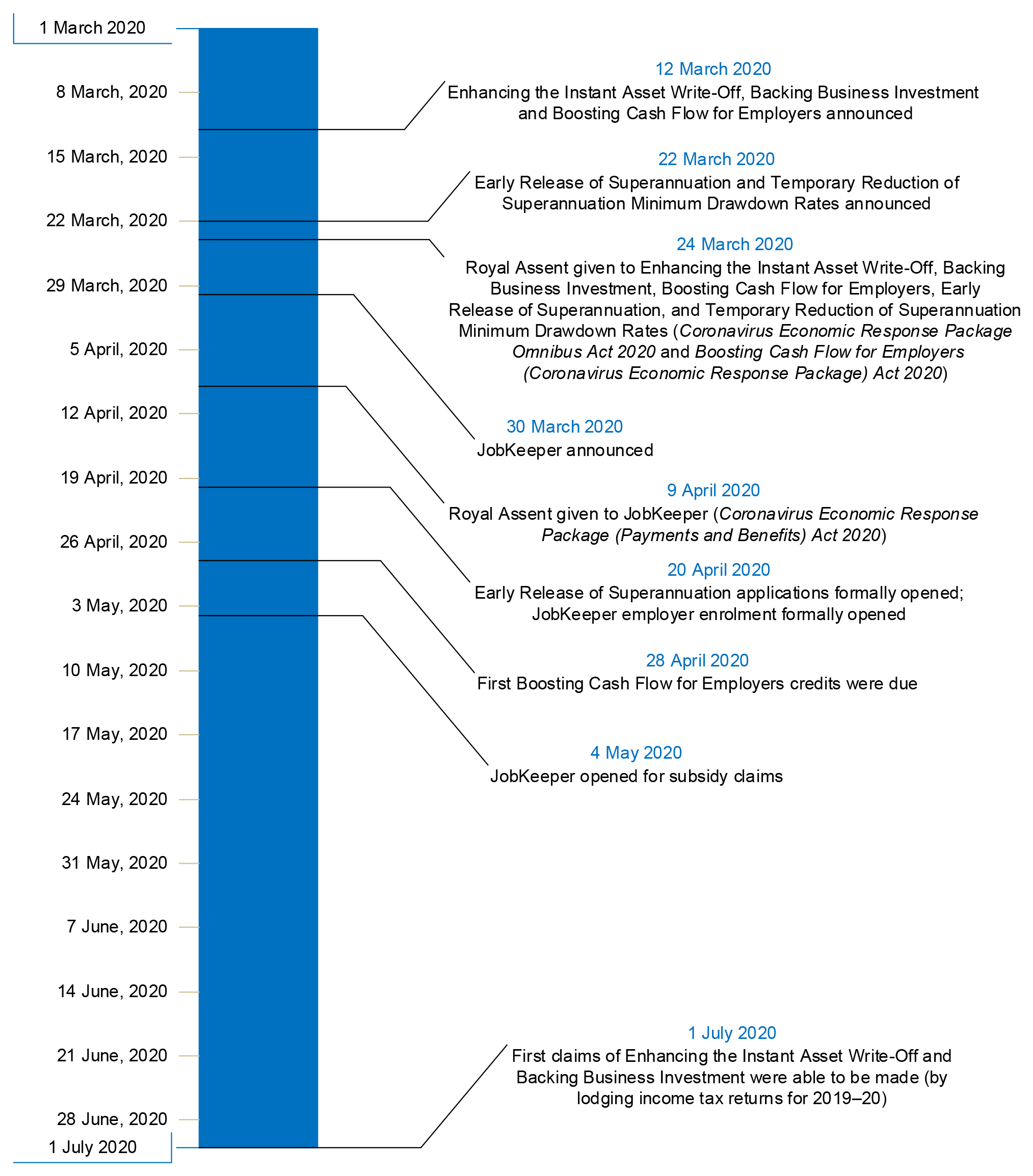

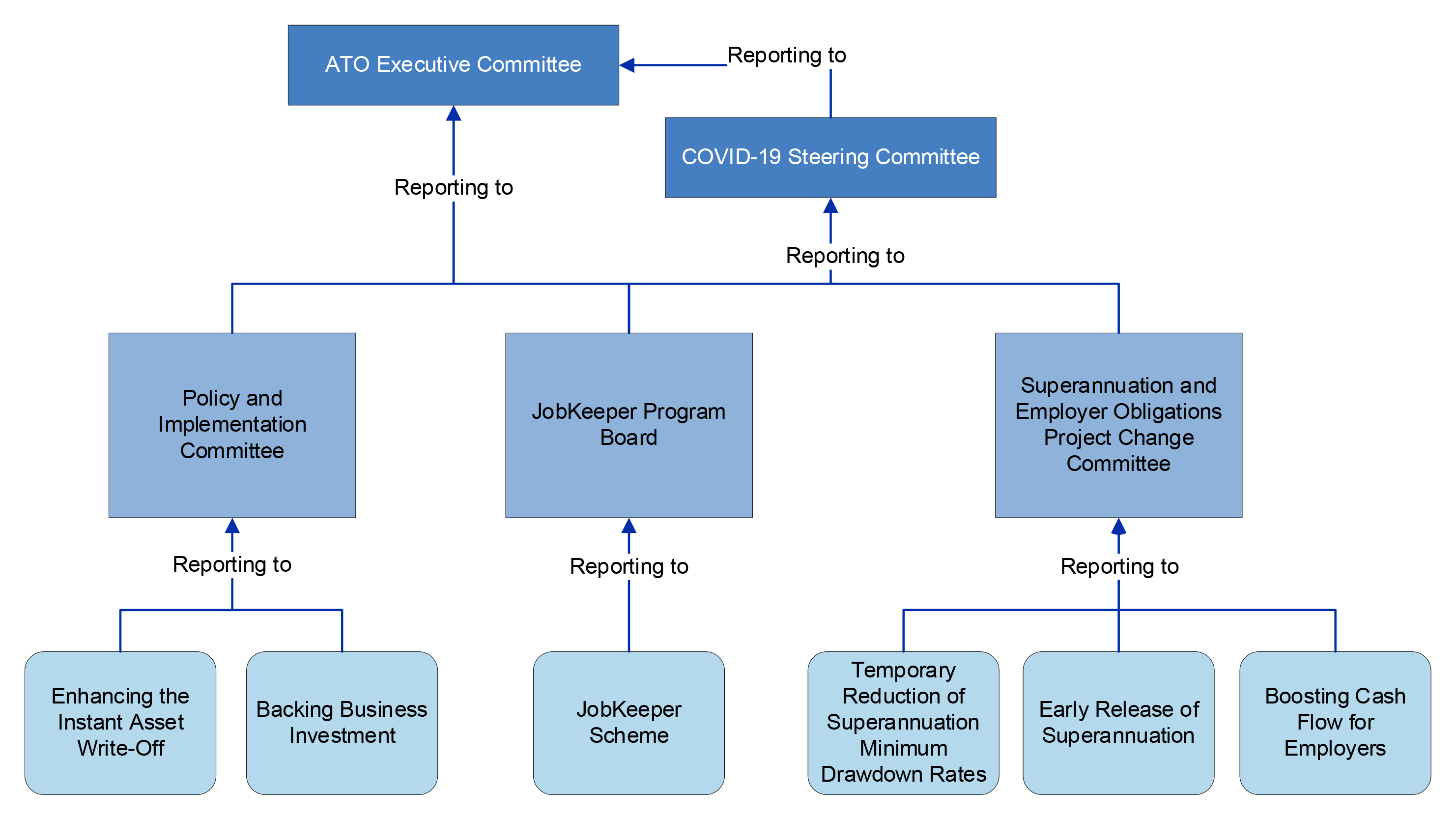

The ATO on Thursday urged all taxpayers to be aware that while the temporary shortcut method will. When you are home the number of hours you worked from rate you need to exclude any time you took a work from working for example the time you spent to stop and eat from lunch or to assist your children with home schooling. As tax time looms the ATO has pointed to four key ineligible work-from-home claims it will be watching closely as taxpayers look to make the most of flexible working arrangements. In essence under the Shortcut Method a taxpayer can claim a flat rate of 80 cents per work hour for all deductible WFH Expenses for the period from 1 March until 30. The Australian Taxation Office S Management Of Risks Related To The Rapid Implementation Of Covid 19 Economic Response Measures Australian National Audit Office.

Source: societyone.com.au

Source: societyone.com.au

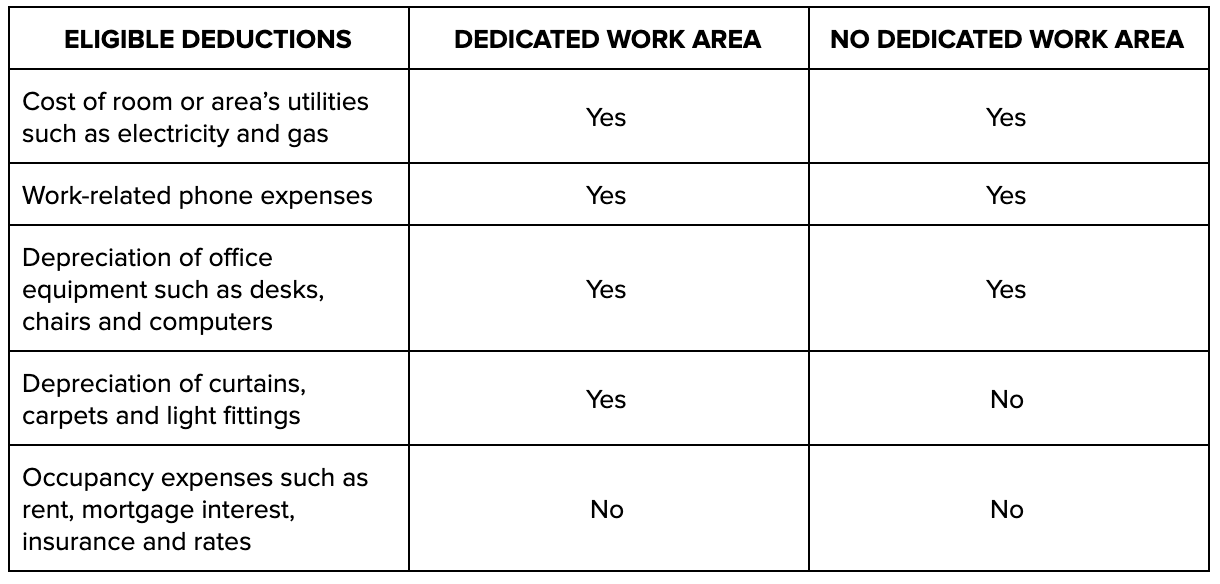

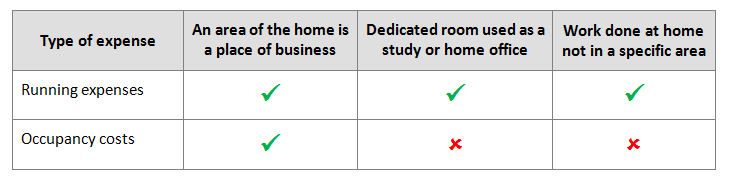

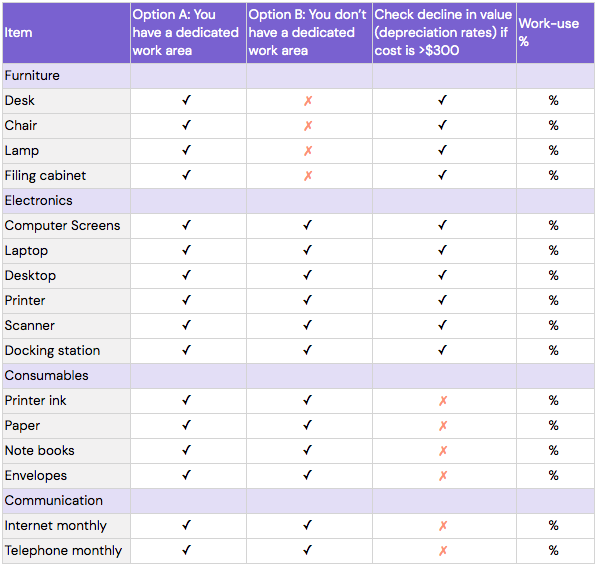

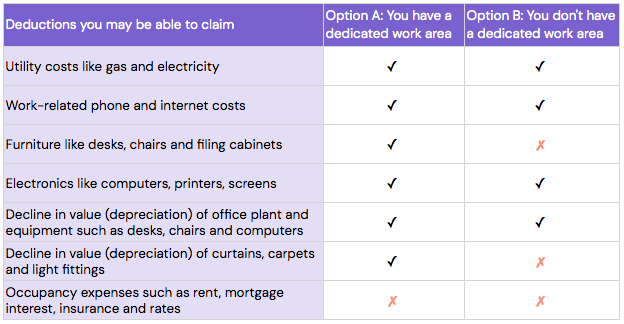

Calculate your work from home deduction. You can claim 080 for every hour you worked from home. You dont need to have a dedicated work area in your home to be eligible to claim using this method. This rate is relevant where an individual decides to use the ATOs safe harbour rate as opposed to keeping records and determining the work-related proportion of actual expenses incurred. Home Office Work From Home Tax Deductions Societyone.

Source: taxbanter.com.au

Source: taxbanter.com.au

Shortcut method if you work from home you can use this method to claim a rate. ATO signals crackdown on 4 ineligible work-from-home claims. A diary of the works spent working from home should be retained to support your claim home of the method used. This recognises that many taxpayers are working from home for the first time and makes claiming a. Claiming Expenses For Working From Home During Covid 19 Taxbanter.

Source: oecd.org

Source: oecd.org

TaxCompliance Jotham Lian 07 April 2020 2 minute read. The ATO on Thursday urged all taxpayers to be aware that while the temporary shortcut method will. Urgent Hiring In Top MNC. Submit Resume And Get Hired. Tax Administration Towards Sustainable Remote Working In A Post Covid 19 Environment.

Source: anao.gov.au

Source: anao.gov.au

The ATO on Thursday urged all taxpayers to be aware that while the temporary shortcut method will. Dont Miss The Opportunity. Dont Miss The Opportunity. Of 80 cents per work hour from between 1 March 2020 to 30 June 2020 in your 201920 tax return 1 July 2020 to 30 June 2021 in your 202021 tax return. The Australian Taxation Office S Management Of Risks Related To The Rapid Implementation Of Covid 19 Economic Response Measures Australian National Audit Office.

Source: anao.gov.au

Source: anao.gov.au

Ato you use this method you cant claim ato work expenses for working from home for that period. The optional 80 cents rate method covers all costs associated with working from home including heating and cooling electricity mobile phone internet and depreciation of office equipment etc. The Australian Taxation Office ATO is announcing special arrangements this year due to COVID-19 to make it easier for people to claim deductions for working from home. The ATO said on Tuesday taxpayers would be allowed to claim a rate of 80 cents per hour for all their running expenses while working at home rather than needing to calculate specific costs. The Australian Taxation Office S Management Of Risks Related To The Rapid Implementation Of Covid 19 Economic Response Measures Australian National Audit Office.

Source: ato.gov.au

Source: ato.gov.au

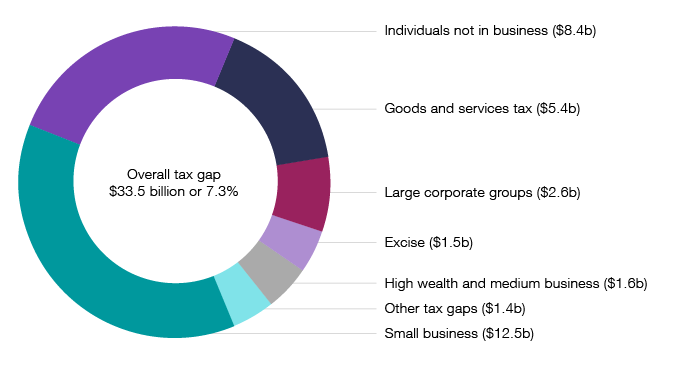

The Australian Taxation Office ATO has introduced a new way to claim tax deductions for working from home in the wake of the COVID-19 pandemic. Urgent Hiring In Top MNC. If youre unsure about anything seek professional advice before you apply for any product or commit to any plan. 5 Home Office Deductions You Can Claim This Tax Time. Tax Gap Program Summary Findings Australian Taxation Office.

Source: mlc.com.au

Source: mlc.com.au

Dont Miss The Opportunity. This new shortcut method will allow workers to claim a deduction of 80 cents for each hour worked between 1 March 2020 until at least 30 June 2020. Its also worth noting that the fixed rate method doesnt include phone internet computer and stationery so these will need to be separately calculated says Andrew. Use our Home office expenses calculator to help you work out your deduction. Working From Home Tax Deductions Covid 19.

Source: ato.gov.au

Source: ato.gov.au

This rate is relevant where an individual decides to use the ATOs safe harbour rate as opposed to keeping records and determining the work-related proportion of actual expenses incurred. As such there are now three methods you can use to calculate home office expenses. This new shortcut method will allow workers to claim a deduction of 80 cents for each hour worked between 1 March 2020 until at least 30 June 2020. Things you bought like a desk your higher bills like electricity or phone. 2016 17 Tax Stats Released Australian Taxation Office.

Source: ato.gov.au

Source: ato.gov.au

This recognises that many taxpayers are working from home for the first time and makes claiming a. TaxCompliance Jotham Lian 07 April 2020 2 minute read. Ad 10M Jobs Biggest Job Search Engine. The Australian Taxation Office ATO is announcing special arrangements this year due to COVID-19 to make it easier for people to claim deductions for working from home. 2016 17 Tax Stats Released Australian Taxation Office.

Source: oecd.org

Source: oecd.org

Dont Miss The Opportunity. Use our Home office expenses calculator to help you work out your deduction. You dont need to have a dedicated work area in your home to be eligible to claim using this method. Fixed rate method if you have a dedicated work area like a home office you can use. Tax Administration Towards Sustainable Remote Working In A Post Covid 19 Environment.

Source: ato.gov.au

Source: ato.gov.au

The fixed rate method involves claiming a flat deduction of 52 cents per hour worked from home to cover electricity and gas decline in value of furniture and furnishings and any repairs. Ato you use this method you cant claim ato work expenses for working from home for that period. This rate is relevant where an individual decides to use the ATOs safe harbour rate as opposed to keeping records and determining the work-related proportion of actual expenses incurred. It could be a home office a converted bedroom or a shed. 2016 17 Tax Stats Released Australian Taxation Office.

ATO rolls out working-from-home deduction shortcut A new simplified method to calculate home office expenses at an increased rate of 80 cents per hour has now been introduced by the ATO in response to a change in national work patterns. This rate is relevant where an individual decides to use the ATOs safe harbour rate as opposed to keeping records and determining the work-related proportion of actual expenses incurred. The shortcut method provides a rate of 80 cents per hour and will only require you to keep a record of the number of hours worked from home Ms Foat said. You dont need to have a dedicated work area in your home to be eligible to claim using this method. Ato Gov Au.

Source: kearneygroup.com.au

Source: kearneygroup.com.au

The ATO said on Tuesday taxpayers would be allowed to claim a rate of 80 cents per hour for all their running expenses while working at home rather than needing to calculate specific costs. The ATO revealed on 7 April its making life easier for those working from home due to new coronavirus restrictions. This recognises that many taxpayers are working from home for the first time and makes claiming a. Calculate your work from home deduction. How To Claim Working From Home Deductions Kearney Group.

Source: kearneygroup.com.au

Source: kearneygroup.com.au

Urgent Hiring In Top MNC. The new arrangement will allow people to claim a rate of 80 cents per hour for all their running expenses rather than needing to calculate costs for specific running expenses. ATO rolls out working-from-home deduction shortcut A new simplified method to calculate home office expenses at an increased rate of 80 cents per hour has now been introduced by the ATO in response to a change in national work patterns. As tax time looms the ATO has pointed to four key ineligible work-from-home claims it will be watching closely as taxpayers look to make the most of flexible working arrangements. How To Claim Working From Home Deductions Kearney Group.