The scheme is intended to be a tax effective way to save a deposit for a first home through a combination of a government contribution and a low tax rate. Heres how it works. Australian government first home saver account.

Australian Government First Home Saver Account, First Home Saver Tax Refund Tax Topics. The Australian government allows first home buyers an opportunity to save through their superannuation known as the First Home Super Saver FHSS scheme. The FHSSS was introduced by the Australian Government to help people save for their first home. Solving the housing affordability problem.

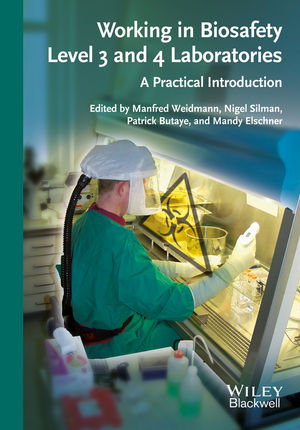

First Home Super Saver Scheme Expert Guide Mozo From mozo.com.au

First Home Super Saver Scheme Expert Guide Mozo From mozo.com.au

The FHSSS was introduced by the Australian Government to help people save for their first home. You can now use your super account to save for a deposit which will help you save faster as super gets special tax treatment. The First Home Saver Account was set up by the Federal Government to get more people to start saving for their first home. FHSA short for first home saver account has the meaning given by section 8.

The Australian Government has come under pressure from First Home Saver Account holders for failing to provide information about withdrawals.

Read another article:

The first home saver accounts were available for those struggling to build up the required deposit for their first home. The Australian government allows first home buyers an opportunity to save through their superannuation known as the First Home Super Saver FHSS scheme. Under the scheme a one-off grant is payable to first home owners that satisfy all the eligibility. When youre ready to purchase your first. This will help first home buyers save faster with the concessional tax treatment of superannuation.

Source: pinterest.com

Source: pinterest.com

Unfortunately this Scheme is now finished by the Australia Government and these accounts are now treated like any ordinary account. First home saver account scheme FHSA 916 In February 2008 the Australian Government announced its intention to introduce a FHSA for those saving to buy a first home. The first home saver accounts were available for those struggling to build up the required deposit for their first home. First Home Saver Account. Australian Renewable Power Plants Map Geothermal Energy Solar Energy Power Plant.

Undeducted non-concessional personal contributions deducted concessional personal contributions. Introduced by the Rudd Government in 2008 the scheme has two main benefits. FHSA short for first home saver account has the meaning given by section 8. First Home Saver Accounts are the first of their kind in Australia and from 1 July 2008 will ensure a couple each earning average incomes and saving for their first home putting aside 10 per cent of their incomes will be able to save a deposit of more. The First Home Super Saver Scheme Can Boost Your Deposit Here S How To Use It Abc Everyday.

Source: thewest.com.au

Source: thewest.com.au

Why use super to save for a home. The FHSSS applies to voluntary superannuation contributions made from 1 July 2017. The Australian Government has come under pressure from First Home Saver Account holders for failing to provide information about withdrawals. FHSA holder has the meaning given by section 9. Further Help For First Homebuyers Pm The West Australian.

Source: mozo.com.au

Source: mozo.com.au

The FHSS scheme allows you to save money for your first home inside your super fund. The FHSSS applies to voluntary superannuation contributions made from 1 July 2017. FHSA eligibility requirements has the meaning given by section 15. First Home Saver Accounts are the first of their kind in Australia and from 1 July 2008 will ensure a couple each earning average incomes and saving for their first home putting aside 10 per cent of their incomes will be able to save a deposit of more. Rip First Home Saver Accounts What Now For Deposit Savers Mozo.

Source: bankaust.com.au

Source: bankaust.com.au

Account holders are unable to access their funds without meeting strict requirements which were intended to be lifted after the Federal Government announced the cessation of the scheme over a year ago in the. What is the First Home Super Saver Scheme FHSSS. It is a national scheme funded by the states and territories and administered under their own legislation. The Australian Government has come under pressure from First Home Saver Account holders for failing to provide information about withdrawals. What You Need To Know About Saving For A Deposit Bank Australia.

Source: mozo.com.au

Source: mozo.com.au

Under the scheme a one-off grant is payable to first home owners that satisfy all the eligibility. Undeducted non-concessional personal contributions deducted concessional personal contributions. Solving the housing affordability problem. The FHSS scheme allows you to save money for your first home inside your super fund. First Home Super Saver Scheme Expert Guide Mozo.

Source: commbank.com.au

Source: commbank.com.au

The FHSSS was introduced by the Australian Government to help people save for their first home. FHSA holder has the meaning given by section 9. They top up 17 on top of your deposits so 6000 1020 government payment. How it works To use the FHSS scheme you need to make voluntary super contributions to your account. First Home Loan Deposit Scheme Commbank.

Source: firstfinancial.com.au

Source: firstfinancial.com.au

Undeducted non-concessional personal contributions deducted concessional personal contributions. This will help first home buyers save faster with the concessional tax treatment of superannuation. First Home Saver Accounts are the first of their kind in Australia and from 1 July 2008 will ensure a couple each earning average incomes and saving for their first home putting aside 10 per cent of their incomes will be able to save a deposit of more. First Home Saver Tax Refund Tax Topics. Government Financial Support Home Buyers First Financial.

Source: pinterest.com

Source: pinterest.com

Undeducted non-concessional personal contributions deducted concessional personal contributions. The Australian Government has come under pressure from First Home Saver Account holders for failing to provide information about withdrawals. The point of the scheme is to help people of all ages get into their first homes sooner. If you have an existing First Home Saver Account dont miss out on any government contributions you may be eligible to claim you have until 30 June 2017 to lodge your claim. Pomonal 15 March 2018 Festival Of Small Halls Small Hall Rural Hall Workshop Architecture.

Source: pinterest.com

Source: pinterest.com

Undeducted non-concessional personal contributions deducted concessional personal contributions. The Australian Government has come under pressure from First Home Saver Account holders for failing to provide information about withdrawals. First home saver account scheme FHSA 916 In February 2008 the Australian Government announced its intention to introduce a FHSA for those saving to buy a first home. Heres how it works. The Inclusions Exclusions And Details Of The Homebuilder In 2021 First Home Buyer Building A House Fruit Flies In House.

Source: pinterest.com

Source: pinterest.com

First Home Saver Account. First home saver accounts are as the name suggests designed to help Australians save for a deposit towards their first home purchase. How it works To use the FHSS scheme you need to make voluntary super contributions to your account. It was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability. Pin By Ourwellnessto Yonge St On Sukin Skin Care Products Womens Health Fitness Womens Health Bronzing.

Source: sydneylivingmuseums.com.au

Source: sydneylivingmuseums.com.au

Heres how it works. What is the First Home Super Saver Scheme FHSSS. When youre ready to purchase your first. First home saver account scheme FHSA 916 In February 2008 the Australian Government announced its intention to introduce a FHSA for those saving to buy a first home. Post War Sydney Home Plans 1945 To 1959 Sydney Living Museums.

Source: pinterest.com

Source: pinterest.com

When youre ready to purchase your first. FHSA short for first home saver account has the meaning given by section 8. FHSA holder has the meaning given by section 9. The first home super saver FHSS scheme was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability. 166kr Cr 150m2 3 Bed 2 Bathrooms Hi Set Design High Set House Plan High Set Design Beach Cottage Home Plan Sale Cottage House Plans Craftsman House Plans House Plans.

Source: br.pinterest.com

Source: br.pinterest.com

The FHSSS was introduced by the Australian Government to help people save for their first home. What is the First Home Super Saver Scheme FHSSS. Open a First Home Saver Account FHSA in the next 4 weeks for free government money. Unlike traditional savings accounts the more money you save the more the government will contribute up to a limit each year. Pin On Australian Retro Style Art Architecture Culture.

Source: theguardian.com

Source: theguardian.com

This will help first home buyers save faster with the concessional tax treatment of superannuation. The First Home Owner Grant FHOG scheme was introduced on 1 July 2000 to offset the effect of the GST on home ownership. If you have an existing First Home Saver Account dont miss out on any government contributions you may be eligible to claim you have until 30 June 2017 to lodge your claim. These voluntary contributions can be made before tax or after tax depending on the approach that works best for you. Budget Superannuation Changes Work Test Scrapped For Some Older Australians And Downsizer Scheme Extended Australian Budget 2021 The Guardian.