As with all other costs be sure to get the exact amount in advance. The majority of lenders will require you to pay a fee for refinancing your loan like legal fees valuation fees. Average cost of refinancing home loan.

Average Cost Of Refinancing Home Loan, A 400000 loan amount variable fixed. This is referred to. Step 4 Consider a no-closing-cost refi. For example if you are refinancing a 200000 home refinancing will cost you between 6000 and 12000.

Another Great Infographic Created By Me Should You Refinance Here S A Great Infographic That Can Hel Mortgage Infographic Mortgage Tips Refinancing Mortgage From pinterest.com

Another Great Infographic Created By Me Should You Refinance Here S A Great Infographic That Can Hel Mortgage Infographic Mortgage Tips Refinancing Mortgage From pinterest.com

Prepayment Penalty - Some lenders charge a penalty fee if you pay off your home mortgage loan early. Your loan amount There are closing costs associated with refinancing your mortgage and can be as high as getting a new loan. Apply for a loan with three to five lenders and compare their refinance fees. The housing finance data from the Australian Bureau of Statistics June quarter revealed that an estimated 40 billion worth of home loans had been refinanced since March.

Estimated monthly payment and APR example.

Read another article:

These fees can easily total up to a sum greater than S3000. At the end of 2020 the median purchase price in. This is a fee you may have to pay when refinancing internally staying with your current lender but switching to a different mortgage product. About 1 of your principal balance. Todays average closing costs are likely higher as home values and loan amounts have been increasing across much of the nation.

Source: pinterest.com

Source: pinterest.com

Your loan amount There are closing costs associated with refinancing your mortgage and can be as high as getting a new loan. Usually refinancing costs the average home owner between 3 and 6 percent of the home loans value. The majority of lenders will require you to pay a fee for refinancing your loan like legal fees valuation fees. You also may be able to get a no-closing cost refinance which doesnt require you. Closingcorp Reports Average Mortgage Closing Cost Data Business Wire Closing Costs Refinancing Mortgage Mortgage.

Source: in.pinterest.com

Source: in.pinterest.com

A 400000 loan amount variable fixed. For example if a borrower is refinancing a 100000 mortgage the. On average it will cost you more than 750 and thats before taking into account mortgage deregistration fees which vary from state to state but tend to be around 150 on average. How Much Does it Cost to Refinance. Preparing For A Refinance Mortgage Mortgage Tool Mortgage Loans Home Mortgage Refinance Mortgage.

Source: pinterest.com

Source: pinterest.com

This is referred to. A 400000 loan amount variable fixed. 4 rows Based on your creditworthiness you may be matched with up to five different lenders. Usually refinancing costs the average home owner between 3 and 6 percent of the home loans value. The Truth About Loan Quotes Truth Quotes Get A Loan.

Source: foxbusiness.com

Source: foxbusiness.com

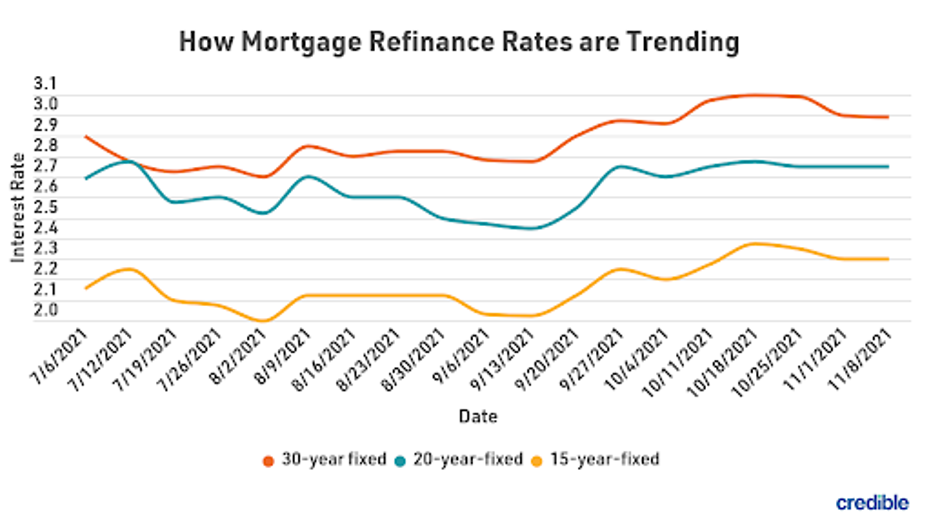

Make certain that you understand ALL of the fees involved in a refinance as lenders have been known to hide costs within the fine print. The cost of this home refinance item will usually average between 400 and 700. This is referred to. Refinancing occurs when an individual or an organization revises its terms of finance including repayment schedule rate of interest credit etc. Today S Mortgage Refinance Rates Hold At Bargain Lows But The Clock S Ticking Nov 15 2021 Fox Business.

Source: investopedia.com

Source: investopedia.com

Thats roughly 282000 in equity on a 414000 home the national average home value. 2300 plus 1 of. See the benefits of a Smart Refinance. Whats the average cost to refinance a mortgage. How Much Does Refinancing A Mortgage Cost.

Source: pinterest.com

Source: pinterest.com

The cost of this home refinance item will usually average between 400 and 700. See the benefits of a Smart Refinance. A lender might be willing to reduce or waive some especially application or origination fees. Estimated monthly payment and APR example. What Are The Typical Closing Costs On A Refinance Refinancing Mortgage Refinance Mortgage Mortgage.

Source: pinterest.com

Source: pinterest.com

Its always worth asking your lender if. According to data released this year the average closing. Its always worth asking your lender if. The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you live according to data from Freddie. Another Great Infographic Created By Me Should You Refinance Here S A Great Infographic That Can Hel Mortgage Infographic Mortgage Tips Refinancing Mortgage.

Source: pinterest.com

Source: pinterest.com

221 Comparison Rate. For example if you are refinancing a 200000 home refinancing will cost you between 6000 and 12000. Make certain that you understand ALL of the fees involved in a refinance as lenders have been known to hide costs within the fine print. The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you live according to data from Freddie. The Average Mortgage Interest Rate By State Credit Score Year And Loan Type Refinance Rates Mortgage Interest Rates Refinance Mortgage.

Source: pinterest.com

Source: pinterest.com

According to the Freddie Mac the average closing costs paid when refinancing a home is 5000. Apply for a loan with three to five lenders and compare their refinance fees. Whats the average cost to refinance a mortgage. Estimated monthly payment and APR example. Infographic How 203k Works Renovation Loan Center Renovation Loans Home Renovation Loan Home Improvement.

Source: pinterest.com

Source: pinterest.com

The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you live according to data from Freddie. Thats roughly 282000 in equity on a 414000 home the national average home value. You can pay a switching fee of between 250-650 to switch loan products. As you can see in the table below refinancing can potentially be very cheap but also very expensive. Sofi Helps Members Save An Average Of 316 Month On Their Student Loans How By Refinancing And Consolida Personal Loans Paying Off Credit Cards Student Loans.

Source: pinterest.com

Source: pinterest.com

About 1 of your principal balance. You may be able to roll your closing costs into your loan balance depending on your lenders requirements. For example if a borrower is refinancing a 100000 mortgage the. Its always worth asking your lender if. The Math Behind The Mortgage Mortgage Tips Refinance Mortgage Home Loans.

Source: pinterest.com

Source: pinterest.com

This is referred to. Step 4 Consider a no-closing-cost refi. Speak up and ask for a better deal. The housing finance data from the Australian Bureau of Statistics June quarter revealed that an estimated 40 billion worth of home loans had been refinanced since March. Loans Archives Napkin Finance Personal Finance Budget Finance Investing Refinance Mortgage.

Source: pinterest.com

Source: pinterest.com

One big thing holding people back from pulling the trigger. Apply for a loan with three to five lenders and compare their refinance fees. Refinancing a home loan can improve a familys monthly cash flow. The housing finance data from the Australian Bureau of Statistics June quarter revealed that an estimated 40 billion worth of home loans had been refinanced since March. Is Now A Good Time To Refinance Absolutely Refinancing Applications Currently Make Up 75 Of All Applications More Than Double Normal Levels In Application.

Source: pinterest.com

Source: pinterest.com

On average it will cost you more than 750 and thats before taking into account mortgage deregistration fees which vary from state to state but tend to be around 150 on average. Title insurance and search. The cost of this home refinance item will usually average between 400 and 700. The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you live according to data from Freddie. As A Mortgage Broker We Have Access To Lender A B C And Everyone Else We Find You The Best Deal That Mortgage Loans Refinance Mortgage Refinancing Mortgage.

Source: pinterest.com

Source: pinterest.com

The majority of lenders will require you to pay a fee for refinancing your loan like legal fees valuation fees. These fees can easily total up to a sum greater than S3000. However the process of rewriting a home loan is not free and knowing the typical refinance costs will be important for anyone thinking about jumping in. A 400000 loan amount variable fixed. Mortgage Loan In Mumbai Lowest Mortgage Rates Mortgage Interest Rates Mortgage Lenders.