With VA loans youll pay a one-time funding fee which ranges from 140 percent to 360 percent depending on how many VA loans youve had and your down payment amount. However its possible to buy a home with as little as 3 down depending on your loan type and credit score. Average percent down on home loan.

Average Percent Down On Home Loan, What is the average down payment on a house. The median loan amount was 283550 and the median loan-to-value ratio the percent of the homes value the loan is worth was 90 indicating that a 10 down payment was about average in early. Depending on the type of loan you get you may be able to put down less than 5. Because outliers can skew an average the telling figure for what other home buyers put down is the median down payment meaning half paid that much or above and half paid that much or below.

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Mortgage Brokers Finance Mortgage From pinterest.com

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Mortgage Brokers Finance Mortgage From pinterest.com

This next chart shows how lenders are likely to view your application if your spending is average but your down payment ranges between 5 and 10 percent. What is the average down payment on a house. Everyones situation is different so dont let these numbers scare you. Down payment percentage You typically are required to pay PMI if you put less than 20 down.

FHA loans are especially common for first-time homebuyers and they require a down payment of just 35.

Read another article:

For first-time homebuyers the average down payment is just 7. For firsttime home buyers that number drops to. On a 15-year mortgage with a fixed interest rate of 4 youd pay around 1184 a monththats principal and interest. The average down payment on a house is 12 first-time buyers put 6 down on average. Interest rate required Check the latest.

Source: in.pinterest.com

Source: in.pinterest.com

The median loan amount was 283550 and the median loan-to-value ratio the percent of the homes value the loan is worth was 90 indicating that a 10 down payment was about average in early. Save more than 96000 long-term. You may even be able to buy a home with no money down if you qualify for a USDA loan or a VA loan. If the loan is for a. Econominute Median Household Income Median Household Income Household Income Income.

Source: pinterest.com

Source: pinterest.com

In 2019 the National Association of Realtors found that the average down payment on a house or condo was just 12. In this scenario youd have to borrow 160000. On a 5 percent 30-year mortgage that higher down payment means paying 9662789 less over the life of the loan – 50000 in less principal repayment plus a total of 4662789 less interest. You may even be able to buy a home with no money down if you qualify for a USDA loan or a VA loan. Fha Loan Pros And Cons Fha Loans Home Loans Fha Mortgage.

Source: lendingtree.com

Source: lendingtree.com

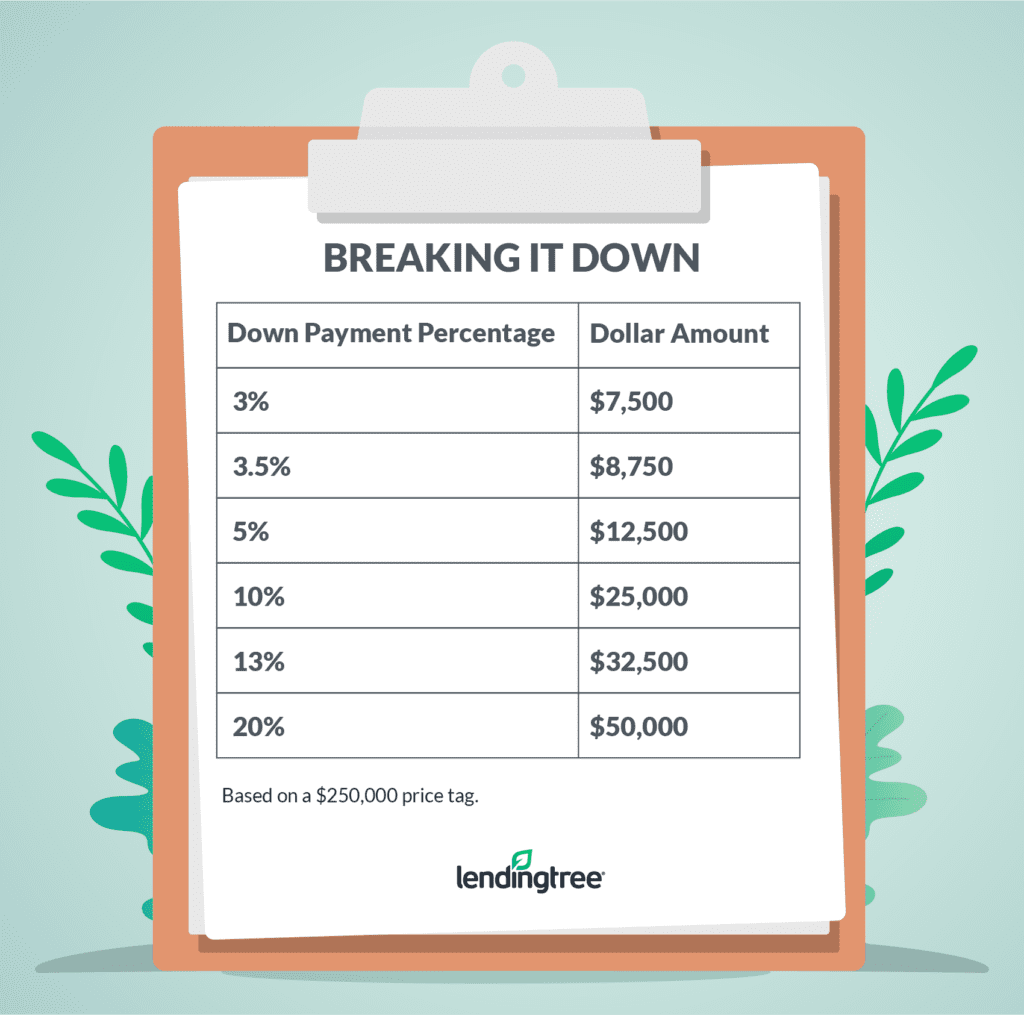

The average mortgage interest rate is 298 for a 30-year fixed mortgage influenced by the overall economy your credit score and loan type. While 5 is the average it doesnt mean you must put that percent down on your own purchase. The minimum down payment required for a conventional loan is 5. However its possible to buy a home with as little as 3 down depending on your loan type and credit score. How Much Should You Put Down On A House Lendingtree.

Source: pinterest.com

Source: pinterest.com

Only a few decades ago it wasnt uncommon for homebuyers to put 20 percent down and more. If the loan is for a. Because outliers can skew an average the telling figure for what other home buyers put down is the median down payment meaning half paid that much or above and half paid that much or below. In 2019 the National Association of Realtors found that the average down payment on a house or condo was just 12. Who Puts 20 Down On A House Not Nearly As Many As You Might Think Home Buying Buying Your First Home Interesting Reads.

Source: pinterest.com

Source: pinterest.com

For first-time homebuyers the average down payment is just 7. You may even be able to buy a home with no money down if you qualify for a USDA loan or a VA loan. One of the best pieces of financial advice for anyone who wants a home soon or later in life is to save save save. The typical down payment on a mortgaged home in 2019 was 10-19 of the purchase price of the home. 100 Financing Zero Down Payment Financing Kentucky Mortgages Home Loans For Ky Mortgage Mortgage Loans Mortgage Tips.

Source: pinterest.com

Source: pinterest.com

The minimum down payment required for a conventional loan is 5. With VA loans youll pay a one-time funding fee which ranges from 140 percent to 360 percent depending on how many VA loans youve had and your down payment amount. For first-time homebuyers the average down payment is just 7. What is the average down payment on a house. What Credit Scores Consist Of For A Kentucky Mortgage Loan Approval For A Fha V Mortgage Loans Pay Off Mortgage Early Mortgage Payoff.

Source: co.pinterest.com

Source: co.pinterest.com

There are conventional loan options that require a down payment of as little as 3 percent but many lenders impose a 5 percent minimum. Depending on the type of loan you get you may be able to put down less than 5. In 2019 the National Association of Realtors found that the average down payment on a house or condo was just 12. While 5 is the average it doesnt mean you must put that percent down on your own purchase. How Long Does It Really Take To Save For A Down Payment Maybe Not As Long As You Think Down Payment Resource Down Payment Thinking Of You Payment.

Source: pinterest.com

Source: pinterest.com

Some special loan programs allow a 35 or even 0 down payment. However its possible to buy a home with as little as 3 down depending on your loan type and credit score. Interest rate required Check the latest. Regardless of how much you have in savings make sure that you dont overpay for a. Do You Need 20 Percent Down Payment On A House He Idea That You Have To Put 20 Percent Down On A Hous First Time Home Buyers Conventional Mortgage Home Buying.

Source: pinterest.com

Source: pinterest.com

Because outliers can skew an average the telling figure for what other home buyers put down is the median down payment meaning half paid that much or above and half paid that much or below. While 5 is the average it doesnt mean you must put that percent down on your own purchase. Because outliers can skew an average the telling figure for what other home buyers put down is the median down payment meaning half paid that much or above and half paid that much or below. In fact according to the National Association of Realtors Profile of Home Buyers and Sellers report in 2019 the median down payment on a. You Know The Money You Could Be Saving At 1 Fee Savings Money Wealth Dollars Millions Savings Plan Life Insurance Policy Mortgage Interest Rates.

Source: in.pinterest.com

Source: in.pinterest.com

Regardless of how much you have in savings make sure that you dont overpay for a. You may even be able to buy a home with no money down if you qualify for a USDA loan or a VA loan. Explore mortgage options that require a 0-35 down payment. In fact according to the National Association of Realtors Profile of Home Buyers and Sellers report in 2019 the median down payment on a. Searching For A Home Loan That Requires No Down Payment Ideal For First Time Home Buyers Th Home Renovation Loan First Time Home Buyers Home Improvement Loans.

Source: pinterest.com

Source: pinterest.com

The average rate for a 30-year fixed rate mortgage is currently 399 with actual offered rates ranging from 313 to 784. The typical down payment on a mortgaged home in 2019 was 10-19 of the purchase price of the home. The average rate for a 30-year fixed rate mortgage is currently 399 with actual offered rates ranging from 313 to 784. On a 5 percent 30-year mortgage that higher down payment means paying 9662789 less over the life of the loan – 50000 in less principal repayment plus a total of 4662789 less interest. Be Prepared For The Fees That Go Along With The Purchase Of Your Home Aolfinance Homebuyertips Home Buying Buying Your First Home Home Buying Process.

Source: in.pinterest.com

Source: in.pinterest.com

Regardless of how much you have in savings make sure that you dont overpay for a. There are conventional loan options that require a down payment of as little as 3 percent but many lenders impose a 5 percent minimum. The post Average Down Payment Percentage appeared first on Home Loans Houston Texas. For first-time homebuyers the average down payment is just 7. Down Payment Amounts Are Up Here S What You Need To Know Down Payment Refinancing Mortgage Mortgage.

Source: pinterest.com

Source: pinterest.com

Only a few decades ago it wasnt uncommon for homebuyers to put 20 percent down and more. Lets say you buy a gorgeous 200000 house on a 20 down payment 40000. The minimum down payment required for a conventional loan is 5. This rate took its lowest dip to 26 in 2009 most likely influenced by the Great Recession. Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Mortgage Brokers Finance Mortgage.

Source: themortgagereports.com

Source: themortgagereports.com

While 20 is the traditional down payment amount 56 of buyers put down less than 20 according to the Zillow Group Consumer Housing Trends Report 2019. Doubling a down payment on a 500000 loan from 10 percent to 20 percent means paying an extra 50000 up front. In other words your loan-to-value is. Down payment percentage You typically are required to pay PMI if you put less than 20 down. First Time Home Buyer Down Payment How Much Is Needed.

Source: pinterest.com

Source: pinterest.com

But still a 20 down payment is considered ideal when purchasing a home. Only a few decades ago it wasnt uncommon for homebuyers to put 20 percent down and more. One of the best pieces of financial advice for anyone who wants a home soon or later in life is to save save save. Interest rate required Check the latest. Pros And Cons Of A Large Down Payment On A House Bad Credit Score Bad Credit Refinance Mortgage.