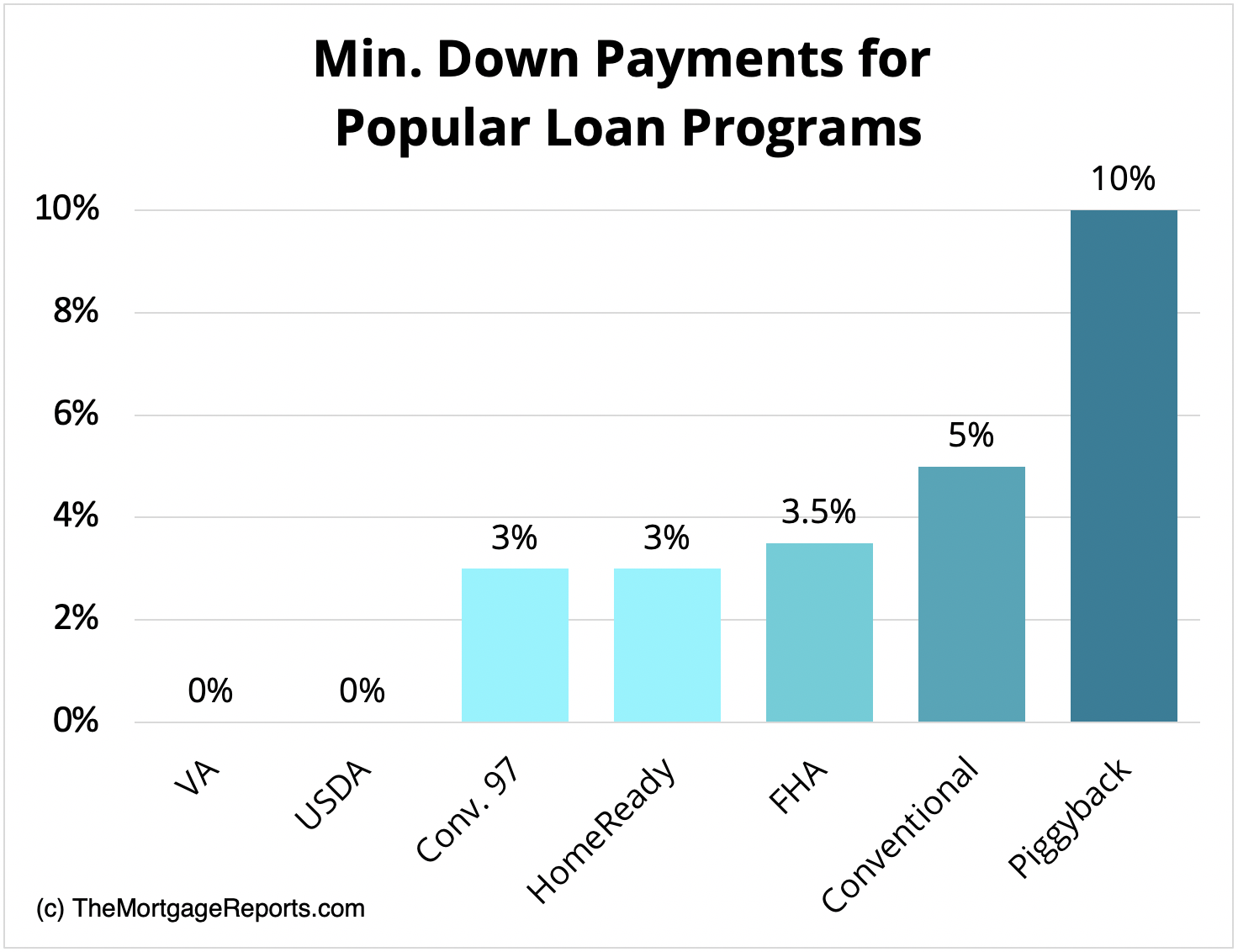

USDA loans are zero-down home loans for people living in rural areas. The remaining 20 of the property value is to be paid by you. Bank loan for home down payment.

Bank Loan For Home Down Payment, Lower down payment loans including the 35 FHA loan are designed to make homeownership more attainable for first-time buyers. Unlike a fixed-rate loan an adjustable-rate mortgage has an interest rate that can go up or down based on market conditions. One of the government-sponsored companies that guarantees conventional loans wont accept a personal loan as a funding source for down payments. Thats only 9000 down for a 300000 home or 6000 down for a 200000 home.

Pros And Cons Of A Large Down Payment On A House Mortgage Infographic Home Buying Home Buying Tips From pinterest.com

Pros And Cons Of A Large Down Payment On A House Mortgage Infographic Home Buying Home Buying Tips From pinterest.com

The easy availability of ready homes and record-low interest rates have made home purchases more affordable. The withdrawal is not taxable as long as you repay it within a 15-year period. Free down payment calculator to find the amount of upfront cash needed down payment percent or an affordable home price based on 3 potential situations when purchasing a home. If your down payment loan is from a top bank it will likely be a 2-5 year loan.

There are multiple lenders offering zero or low down payment mortgages including a few traditional banks and many online lenders.

Read another article:

FHA loans are best known as first-time homebuyer loans. The down payment often covers a meaningful percentage of the total purchase price such as 20. These include Quicken Loans SoFi Flagstar Bank Bank of America Suntrust and PNC Mortgage. Using Your RRSP as a Down Payment Under the federal governments Home Buyers Plan first-time home buyers are eligible to use up to 35000 in RRSP savings per person 70000 for couples for a down payment on a home. Whenever you borrow a home loan lenders such as banks and Non-Banking Financial Companies NBFCs usually shell-out 80 of your propertys worth as a loan amount.

Source: pinterest.com

Source: pinterest.com

They are also a great option for borrowers who have subprime credit. These include Quicken Loans SoFi Flagstar Bank Bank of America Suntrust and PNC Mortgage. You pay off the remainder of the loan over time with regular installment payments unless you pay the loan off early with a large payment or by refinancing. Conventional and government-backed home loansdo not allow for the down payment to come from a loan of any kind. How Much Down Payment Do You Really Need To Buy A House A Very Frequently Asked Question And Most Of You Will Be Surprise Easy Loans Do You Really Investing.

Source: pinterest.com

Source: pinterest.com

One of the government-sponsored companies that guarantees conventional loans wont accept a personal loan as a funding source for down payments. Also experiment with mortgage calculator or explore hundreds of other calculators addressing finance math fitness health and. Down payment is defined as the amount you pay upfront to the seller or property owner. This 20 is the down payment. How To Buy A House With 0 Down In 2020 First Time Buyer Personal Finance Lessons Buying First Home Va Loan.

Source: gr.pinterest.com

Source: gr.pinterest.com

With an FHA loan you can buy a home with as little as 35 down if your credit score is 580 or higher. Lower down payment loans including the 35 FHA loan are designed to make homeownership more attainable for first-time buyers. Lenders want the down payment funds to come directly from the borrower and not have to be repaid. Borrow Against the Equity in Another Property Borrow from Friends and Family Borrow from Retirement Funds Borrow Using a Personal Loan. Do S And Don Ts During The Home Loan Process Mortgage Payoff Mortgage Tips Paying Off Mortgage Faster.

Source: pinterest.com

Source: pinterest.com

For example you buy a house for 200000. You also qualify under self-employment if your funds are from capital gains interest dividends from securities. The withdrawal is not taxable as long as you repay it within a 15-year period. Banks issue only up to 90 of the property value as home loan and the remaining 10 plus additional expenses involved in the transaction has to be borne by the buyer. Pros And Cons Of A Large Down Payment On A House Mortgage Infographic Home Buying Home Buying Tips.

Source: pinterest.com

Source: pinterest.com

Down payment assistance DPA programs help home buyers with loans or grants that reduce the amount they need to save for a down payment. Down payment assistance DPA programs help home buyers with loans or grants that reduce the amount they need to save for a down payment. Thats only 9000 down for a 300000 home or 6000 down for a 200000 home. They are also a great option for borrowers who have subprime credit. All Main Aspects About A Down Payment Canada Wide Financial Down Payment Earn Money Payment.

Source: pinterest.com

Source: pinterest.com

Over the years home loan interest rates have gone down considerably with some banks offering rates as low as 825 pa. Down payment is defined as the amount you pay upfront to the seller or property owner. Lenders want the down payment funds to come directly from the borrower and not have to be repaid. If you opt for a home equity loan for a down payment youll receive money in a lump sum and make fixed monthly installment payments based on the rate and term you choose. How To Save For A Mortgage Down Payment Down Payment Savings Tips Down Payment Assistance May Be Available To You To Re Loan Money Down Payment Saving Tips.

Source: pinterest.com

Source: pinterest.com

The APR of loans offered by a top bank may range from 55 to 145. Taking out a personal loan for a home down payment means that loan will affect your DTI calculation and could possibly raise your DTI to exceed the lenders allowable limits. The minimum down payment for home loan in India is set at 20. Pros and cons of tapping home equity for a down payment. What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage.

Source: pinterest.com

Source: pinterest.com

For example you buy a house for 200000. The remaining 20 of the property value is to be paid by you. There are multiple lenders offering zero or low down payment mortgages including a few traditional banks and many online lenders. However if you do not have enough funds saved you will may need to consider other options for. Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator House Down Payment Savings Plan.

Source: pinterest.com

Source: pinterest.com

However these loans which only require a 35 down payment offer excellent terms for anyone struggling to save up a large down payment. There are several loan options you can explore to cover a down payment including. Banks issue only up to 90 of the property value as home loan and the remaining 10 plus additional expenses involved in the transaction has to be borne by the buyer. USDA loans are zero-down home loans for people living in rural areas. Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval Louisville Kentucky Mortgage Loans No Credit Loans Bad Credit Mortgage Credit Score.

Source: pinterest.com

Source: pinterest.com

The short answer is no. This program allows Canadians to borrow as much as 25000 from their RRSPs 50000 for a couple to be put towards a down payment on the purchase of a home. The RBI has directed banks and NBFCs to grant only 80 of the property value as loan and the rest 20 has to be arranged by the borrower. Rocket MortgageSM requires a minimum score of 580. Be Informed And Purchase With Caution Here S An Overview Of An 80 10 10 Goldenpointfinance Loans Credit Agencies Mortgage Brokers Credit Worthiness.

Source: pinterest.com

Source: pinterest.com

Can You Use a Loan for a Down Payment on a House. It consists of an 80 percent first mortgage a second mortgage and usually a. The minimum down payment for a house depends on the loan youre using to finance the purchase. USDA Loans USDA loans are for people who are looking to buy homes in rural or suburban areas. Five Ways To Save For A Home Loan Visual Ly Home Loans Home Improvement Loans Loan.

Source: pinterest.com

Source: pinterest.com

Even an FHA loan requires a larger down payment of 35. Borrow Against the Equity in Another Property Borrow from Friends and Family Borrow from Retirement Funds Borrow Using a Personal Loan. These include Quicken Loans SoFi Flagstar Bank Bank of America Suntrust and PNC Mortgage. Can You Get a Loan for a Down Payment. Pin On Economy Infographics.

Source: pinterest.com

Source: pinterest.com

Free down payment calculator to find the amount of upfront cash needed down payment percent or an affordable home price based on 3 potential situations when purchasing a home. Lenders want the down payment funds to come directly from the borrower and not have to be repaid. Can You Get a Loan for a Down Payment. Thats only 9000 down for a 300000 home or 6000 down for a 200000 home. Idbi Bank Home Loan Offers Flexible Loan Repayment Options And Lower Emis At Attractive Interest Rates Calculate Your Eligib Home Loans Loan Account Idbi Bank.

Source: themortgagereports.com

Source: themortgagereports.com

For example you buy a house for 200000. Whenever you borrow a home loan lenders such as banks and Non-Banking Financial Companies NBFCs usually shell-out 80 of your propertys worth as a loan amount. One of the government-sponsored companies that guarantees conventional loans wont accept a personal loan as a funding source for down payments. Pros and cons of tapping home equity for a down payment. How To Buy A House With 0 Down In 2021 First Time Buyer.

Source: pinterest.com

Source: pinterest.com

Free down payment calculator to find the amount of upfront cash needed down payment percent or an affordable home price based on 3 potential situations when purchasing a home. Standard HEL terms are five to 15 years. One of the government-sponsored companies that guarantees conventional loans wont accept a personal loan as a funding source for down payments. However these loans which only require a 35 down payment offer excellent terms for anyone struggling to save up a large down payment. What Is A Typical Down Payment On A House Growthrapidly House Down Payment Down Payment Personal Finance.